Global Tech Titans Lose $108 Billion Amid DeepSeek-Induced Market Turmoil

Nvidia's Jensen Huang Leads Losses as Chinese AI Firm DeepSeek Disrupts Industry

On Monday, the world's 500 wealthiest individuals collectively saw a staggering $108 billion wiped from their fortunes, driven by a tech-centric market selloff linked to Chinese artificial intelligence developer DeepSeek. This downturn led to significant declines in major stock indices.

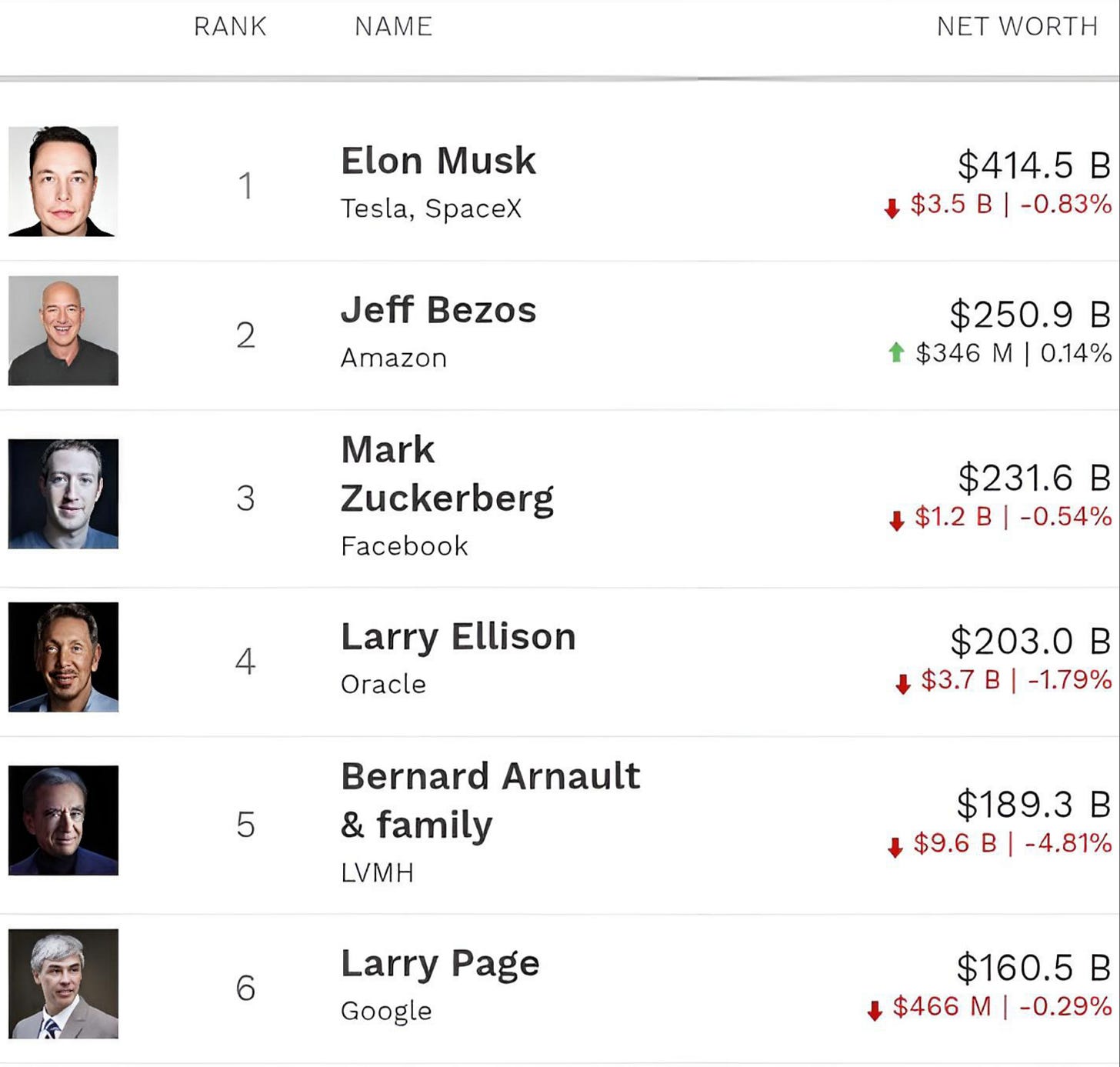

Nvidia Corporation's co-founder and CEO, Jensen Huang, was among the most affected. Nvidia's stock plummeted 17%, closing at $118.42, marking its steepest drop since March 2020. This decline resulted in a $20.7 billion reduction in Huang's net worth, pushing him down the global wealth rankings.

The market upheaval was triggered by DeepSeek, a Hangzhou-based AI startup founded in 2023. The company unveiled an advanced AI model, DeepSeek-R1, which rivals offerings from U.S. tech giants like OpenAI but was developed at a fraction of the cost. DeepSeek's innovative approach utilizes a "mixture of experts" technique, activating only necessary computing resources for specific tasks, thereby enhancing efficiency.

Investors expressed concerns that DeepSeek's cost-effective AI solutions could undermine the competitive edge of established U.S. technology firms. This sentiment led to a broader selloff in the tech sector, with significant losses reported by other industry leaders.

The emergence of DeepSeek has prompted a reevaluation of the global AI landscape, highlighting the rapid advancements of Chinese technology companies and their potential to disrupt established markets. As the situation develops, stakeholders will closely monitor the responses of U.S. tech giants to this new competitive challenge.